Working in Japan: Filing a Tax Return

In a series of blog posts I want to try to explain some basics of how income tax and municipal tax work in Japan, how furusato nozei works and how you can have certain expenses deducted from your taxable income. In this particular post I will explain when you may want to file a tax return and how your income tax may reduce by that. If you haven't done yet, consider to read the previous post about End-of-Year Adjustment and Income Tax to understand the basics of the example presented in this post.

Disclaimer: I am not a professional in the field and have only a limited understanding of the Japanese tax system. This article is not financial advice and doesn't claim to be applicable for your use or even correct at all. All numbers stated in this article (deduction limits etc.) were valid in fiscal year 2016 and may have changed since.

Why to File a Tax Return

As described in the previous post in this series, you are usually done with your tax duties after completion of the end-of-year adjustment. However, certain types of expenses can be used to reduce your taxable income, so if you have had such expenses, it may make sense to file a tax return. Such expenses can be, for example,

- health-related expenses (e.g., dentist, child birth, ...) above 100,000 JPY,

- donations (e.g., to Japanese Red Cross, also furusato nozei) above 2,000 JPY,

- tax paid on capital gains, if you have also realized capital losses to offset them with,

- any expenses for life insurance etc. that you forgot to state in your end-of-year adjustment.

Furthermore, if you had other sources of income such as a second job, or if your gross salary is above 20,000,000 JPY you may have to file a tax return.

How to File a Tax Return

Let's continue where we left off in the example for the Statement of Earnings: Assume that you are a single, have had a gross salary of 5,000,000 JPY in the past year, paid 700,000 JPY for social insurance, therefore had a taxable income of 2,380,000 JPY and paid, after the end-of-year adjustment, a total income tax (including surtax) of 143,400 JPY. Further assume that you want to file a tax return because you had 150,000 JPY health-related expenses and made donations with a total amount of 100,000 JPY. Let's say, one because you discovered that many children in Japan live in poverty and wanted to support an institution that helps families with poor children, and one as furusato nozei (“hometown tax”) to get some delicious sake and drink it to forget about the misery in the world. For the income tax return, both are treated as “donations” and reduce your taxable income.

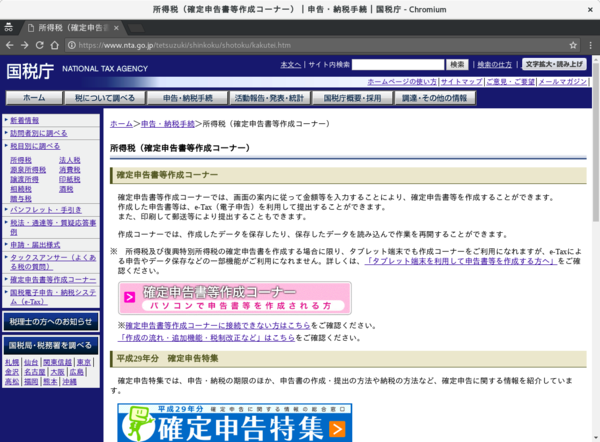

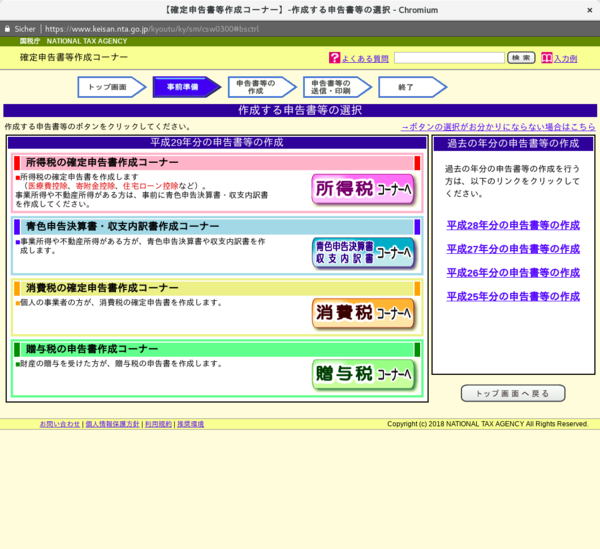

First, visit https://www.nta.go.jp/tetsuzuki/shinkoku/shotoku/kakutei.htm, which looks like the screenshot below. Click the pink button, which will take you to the page where you can create your tax return.

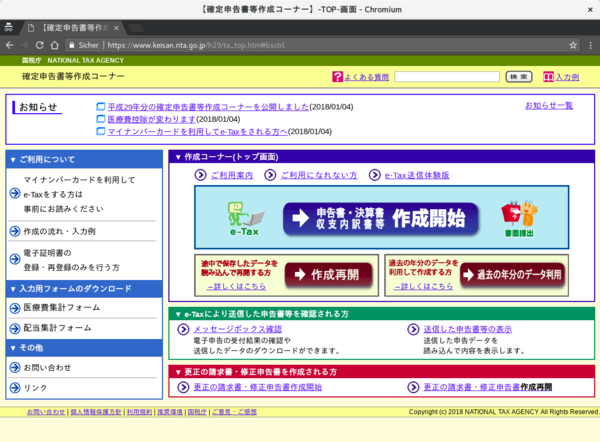

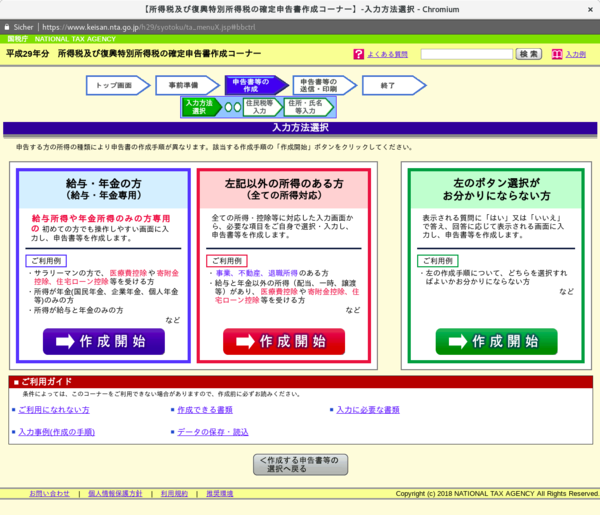

On this page you can either resume from a previously downloaded data file or a data file from previous years, or start from zero. Click the blue button to create a new tax return.

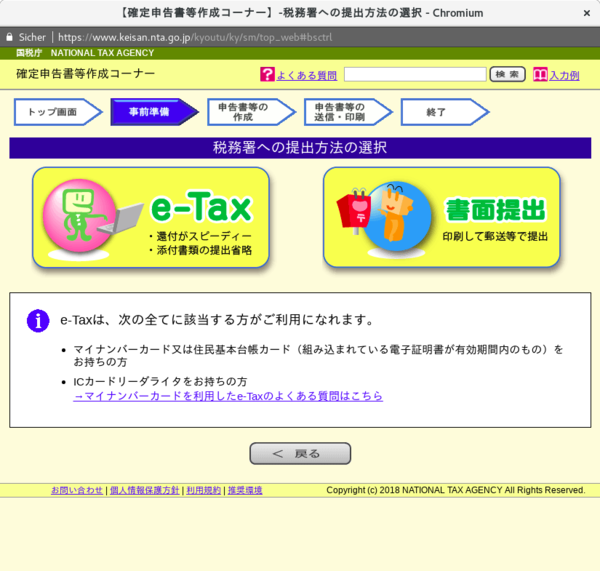

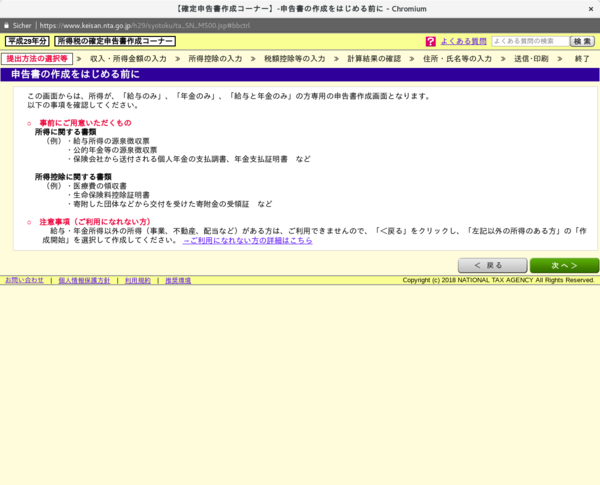

You can file your tax return electronically (which requires a “MyNumber Card” and an electronic card reader), or create a PDF file from your input data, which you then have to print and send to your local tax office. For the purpose of this tutorial, click the right yellow button to create a “paper” tax return.

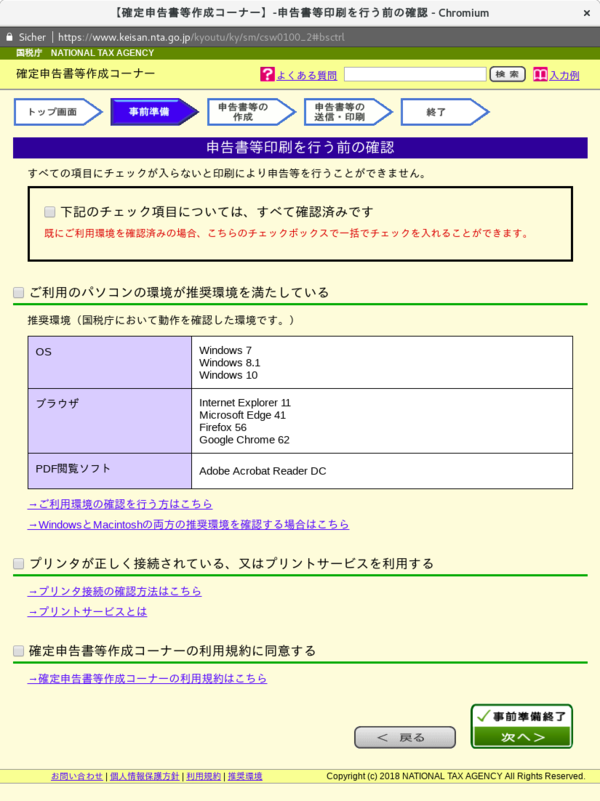

Check all three boxes to confirm that you can use the website, print documents, and agree to the Terms of Service. Click the green button in the lower right to continue.

Since you want to file an income tax return, click the purple button.

This page asks you for the kind of income that you receive. In this example we assume that you receive a regular salary from a single job, so click the blue button to continue.

This is only a confirmation screen, so click the green button in the lower right to continue.

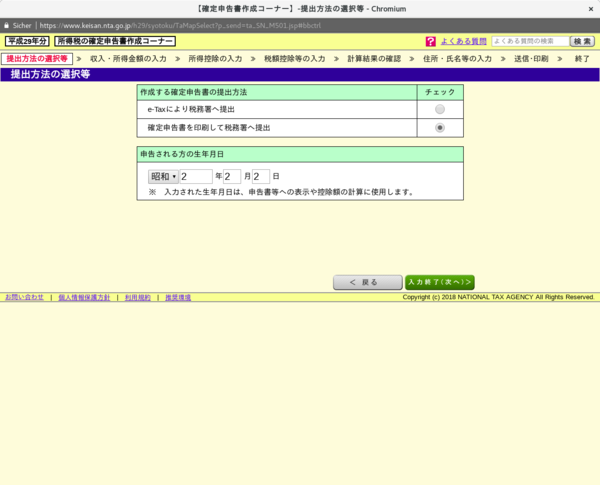

This screen asks you again whether you want to file electronically or on paper. The “paper” choice should be pre-selected, so just enter your date of birth and click the green button in the lower right to continue.

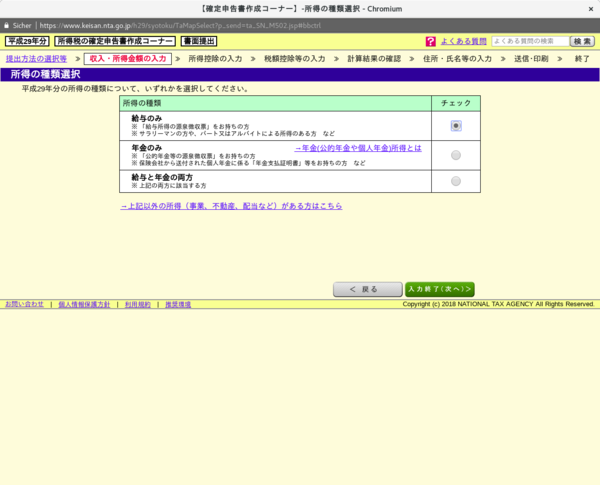

This screen asks whether you receive a salary, pension, or both. Pick the topmost option (“only salary”) and click the green button in the lower right to continue.

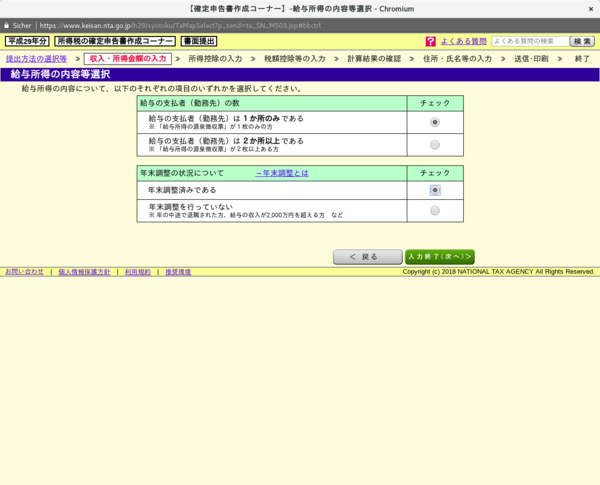

This screen asks whether you receive salary from only one company or more than two companies, and also whether you have done your end-of-year adjustment. Pick the top option in both boxes, then click the green button in the lower right to continue.

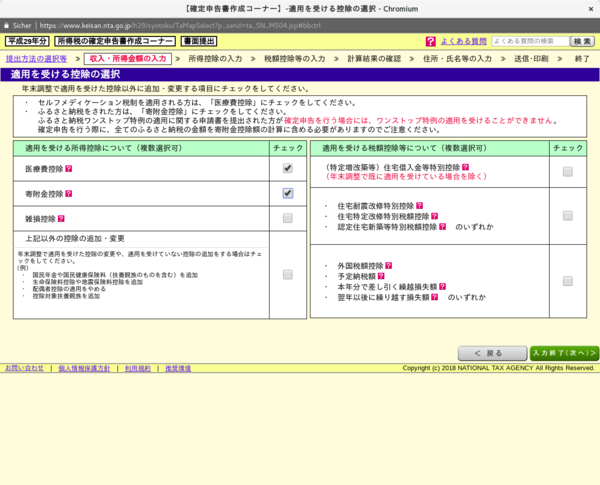

This screen asks what kind of entries you want to make to your tax return. For this example we consider only health-related expenses and donations, so pick the two topmost options in the left box, then click the green button in the lower right to continue.

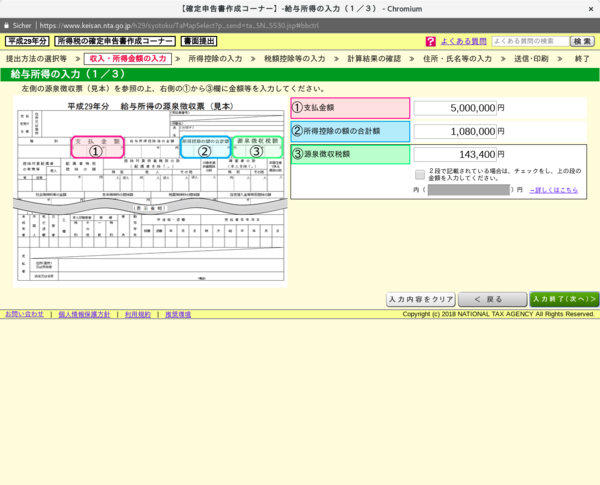

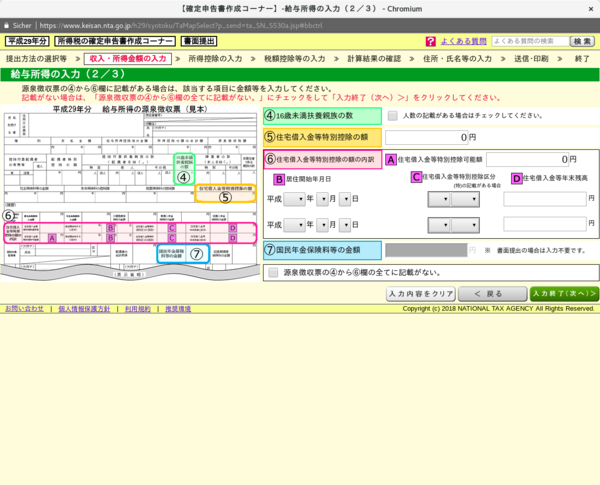

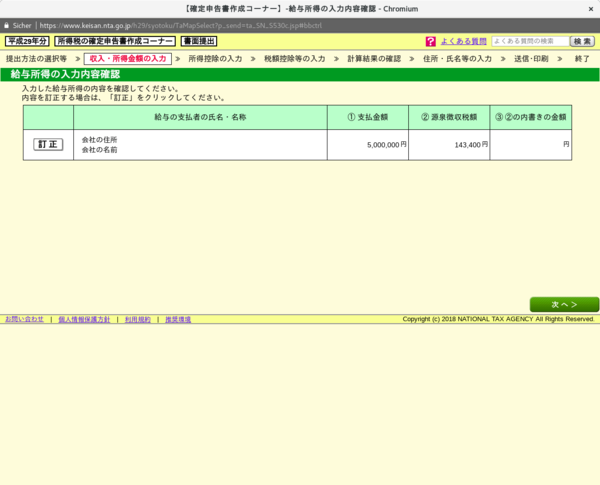

Now you have to enter the numbers as shown on your Statement of Earnings. This is surprisingly easy, because on the left it tells you exactly which numbers from that statement to copy into which field of the web form. (1) is your total gross salary, 5,000,000 JPY, (2) is the sum of all deductions, 1,080,000 JPY, and (3) the total amount of income tax (including surtax) that you paid, 143,400 JPY.

By the way, if the numbers are not correct and you just enter any random value, the site will politely tell you that either you mistyped something or your end-of-year adjustment was not done correctly. Click the green button in the lower right to continue.

This screen as well is just copy and paste from your Statement of Earnings. In this example we assume that all those entries are zero. Click the green button in the lower right to continue.

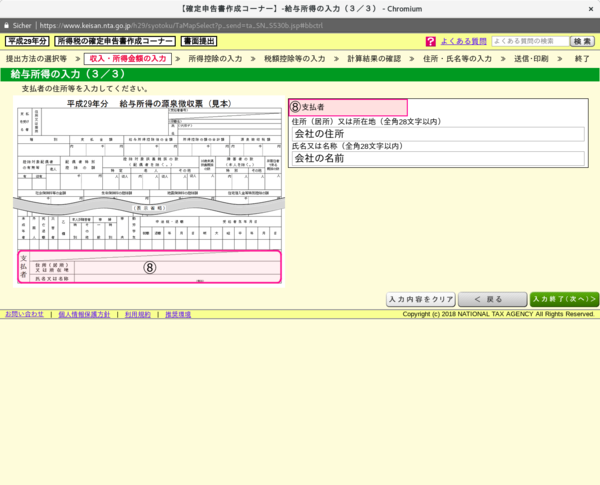

In this screen you have to write your employer's name, also just copy and paste. Click the green button in the lower right to continue.

This is just a confirmation screen, so click the green button in the lower right to continue.

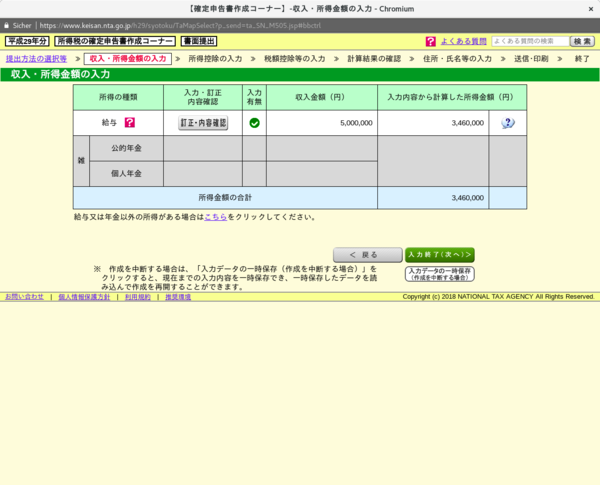

This screen is only relevant if you receive a pension, so click the green button in the lower right to continue.

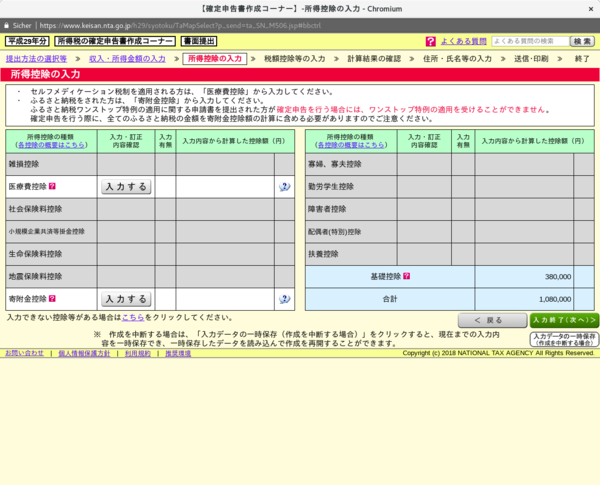

Now finally this is the interface from which you can enter your additional expenses. I have not made screenshots for each workflow, but using the button 入力する (“input”) you can enter your health-related expenses and your donation details. (As for anything described in this blog post, if your level of Japanese is not sufficient to understand what you are doing in this form, do it with a person of trust that has that level of Japanese.)

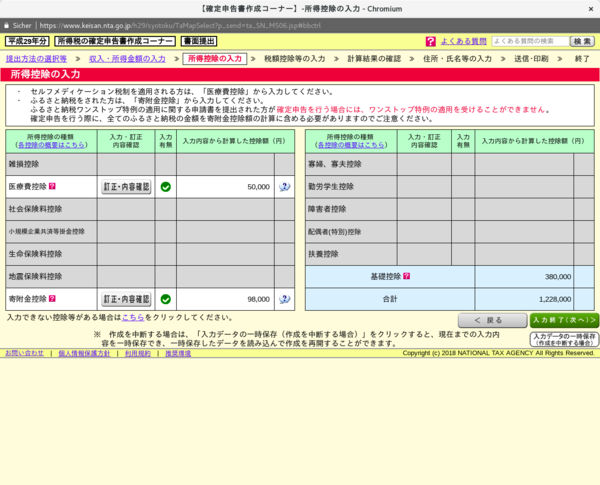

When you are done with that, you will return to this screen with the numbers filled in. You will notice that not the full amount of your expenses is visible here, but only the portion that is tax-deductible, that is

- only the amount exceeding 100,000 JPY for health-related expenses and

- only the amount exceeding 2,000 JPY for donations.

After checking that everything is correct, click the green button in the lower right to continue.

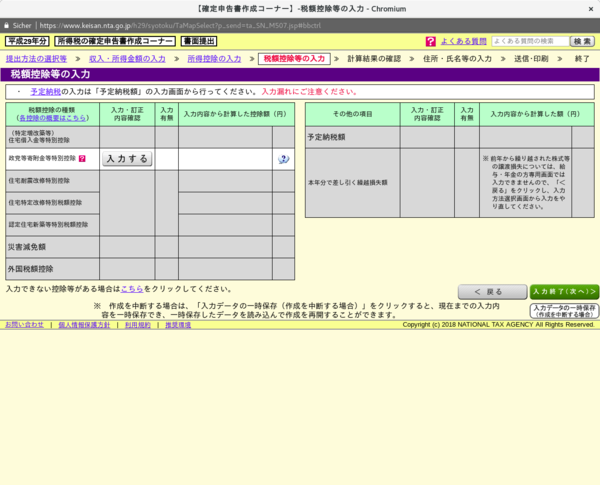

This screen only asks for something that we don't use for this example, so just click the green button in the lower right to continue.

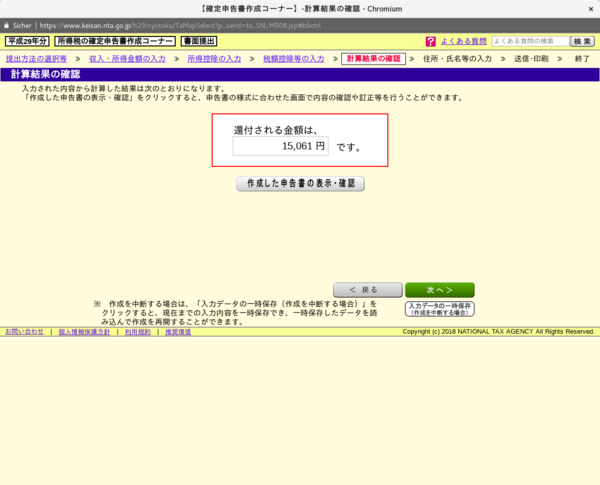

Great, the hard part is done! This screen tells you how much money you will be paid back after filing your tax return. Click the white button below the red-bordered box to see a preview of your tax return form.

Now you see a colorful version of the sheet that you will later print and send to your local tax office.

Let's check the numbers in there. Field (ア), 5,000,000 JPY, is your total gross salary, field (1), 3,460,000 JPY, is the amount after your general salary deduction. Field (16), 1,080,000 JPY, shows the sum of all your deductable expenses such as life insurance, housing loan etc. – all these numbers should be the same as those in your Statement of Earnings.

Now comes the new part. Field (18), 50,000 JPY, shows the tax-deductible amount of your health-related expenses, field (19), 98,000 JPY, the tax-deductible amount of your donations, and field (20), 1,228,000 JPY the sum of these two numbers and the value in (16).

Field (21) in the right column, 2,232,000 JPY, shows your new taxable income, computed as (5)–(20). Note that before your taxable income was 2,380,000 JPY, so it has in fact reduced. The new income tax amount, computed by

97,500 JPY + (2,232,000 JPY – 1,950,000 JPY) x 0.10 = 125,700 JPY,

is written in field (22), and the additional 2.1% surtax of that amount, 2,639 JPY, can be found in field (35). The sum of both, 128,339 JPY, is shown in field (36), and it is 15,061 JPY less than your previous total income tax amount of 143,400 JPY. Congratulations! :-)

The rest of the work, if you decide that 15,000 JPY are worth the effort, consists of filling in all your personal information like name, address, ID number, bank account, printing the document, glueing all your receipts on the papers, and sending it to your local tax office. A couple of weeks later you will find the difference amount on your bank account.

In this post I have explained the basics of how to file a tax return and how to compute the amount that you will actually get reimbursed later. One point that was only briefly touched in this post was furusato nozei. The promise of furusato nozei is that you can “pay your tax in a different city”, but so far it was only treated like an ordinary donation, so until now only 10% (or whatever your personal income tax rate is) have been reimbursed. In a future post I will explain how the remaining 90% come back to you and how to check that they actually did.