Working in Japan: End-of-Year Adjustment and Income Tax

So now you have moved to Japan and started to settle here. You have a job, a regular income, maybe a spouse or even children. Maybe you have heard about this furusato nozei thing that everyone gets excited about towards the end of the year, or maybe you have had some health expenses that you would like to have deducted from your salary to reduce taxes. But actually, how does it all work? After all, the tax system is not the thing that most people get too excited about when they decide to move to a different country.

In a series of blog posts I want to try to explain some basics of how income tax and municipal tax work in Japan, how furusato nozei works and how you can have certain expenses deducted from your taxable income. In this particular post I will explain what the end-of-year adjustment is and how your income tax is computed from your total salary.

Disclaimer: I am not a professional in the field and have only a limited understanding of the Japanese tax system. This article is not financial advice and doesn't claim to be applicable for your use or even correct at all. All numbers stated in this article (deduction limits etc.) were valid in fiscal year 2016 and may have changed since.

End-of-Year Adjustment (年末調整, nenmatsu chōsei)

When you work as a normal employee in a Japanese company, then you receive a salary every month. And you may have noticed that the amount you see on your bank statement is not the same amount that is written in your work contract, the reason being that the company pays social insurance (e.g., health insurance, unemployment insurance and some contributions to the pension system) and also income and municipal tax on your behalf.

However, the amount of income tax that you owe depends on the income in a whole calendar year, not the income per month, so the total amount you owe is only known at the end of the year. For example, your salary may change during the year and you may jump to a different tax bracket. Or your spouse may stop working and you are now eligible for some special deductions. Therefore, the amount of income tax paid by your company each month only corresponds to an estimate of that figure.

In order to eventually compute the correct amount at the end of the year, your accounting department may ask you to fill out a form for end-of-year adjustment (nenmatsu chōsei). In that form you have to state your dependents and their income, and other deductible expenses such as premiums for certain insurances or a housing loan. Then, depending on the data in this form and the total salary you received in that year, the actual total amount of income tax is computed and any difference is paid back or needs to be paid in addition.

Statement of Earnings (給与所得の源泉徴収票, kyūyoshotoku no gensenchōshūhyō)

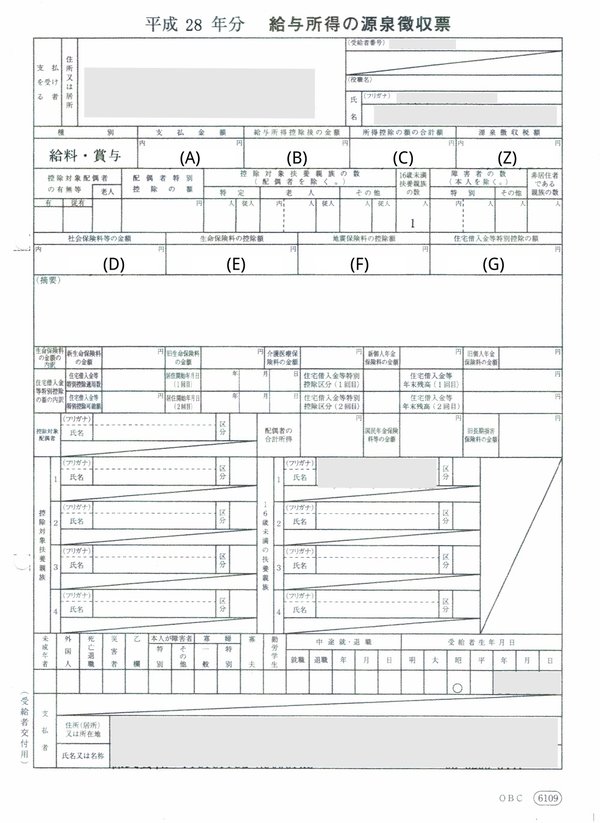

As a certificate of your tax payments and the result of the computation in the end-of-year adjustment, you may receive a sheet like the one below.

Let's try to understand the numbers in there. First, the amount written in A (支払金額) is your total gross salary (not the amount that you were actually paid!), including bonuses, overwork payment etc. From this number A, an allowance for common expenses in your employee life (給与所得控除) is deducted. The result is written in B (給与所得控除後の金額). Next, the field in C (所得控除の額の合計額) contains the sum of all deductable items. In particular, these are

- D (社会保険料等の金額, social insurance fees that were paid by your employer),

- E (生命保険料の控除額, deduction for life insurance fees),

- F (地震保険料の控除額, deduction for earthquake insurance fees),

- G (住宅借入金等特別控除の額, deductions for a housing loan), but also

- the basic deduction that applies to everyone (基礎控除, 380,000 JPY) as well as

- the deductions for dependents (特定扶養控除, e.g., 380,000 JPY for a spouse with sufficiently low income and children 16–18 years of age, 630,000 JPY for children 19–23 years of age).

The total taxable income is actually not written on that paper, but it is computed as B–C. From that amount, the total income tax is computed as per the rates described nicely on this pwc page and can be seen in Z (源泉徴収税額).

Let's try to do the math with some example numbers. Say that your gross salary A is 5,000,000 JPY. First, looking at this table your salary falls into the 3,600,000–6,600,000 JPY bracket, so you can deduct an amount of 540,000 JPY + 5,000,000 JPY x 0.20 = 1,540,000 JPY, leaving you with B = 5,000,000 JPY – 1,540,000 JPY = 3,460,000 JPY. Assume that you have paid 700,000 JPY for social insurance D in the past year and that you are either single (or at least have no tax-relevant dependents), so that you only get your own basic deduction of 380,000 JPY, then you have C = 700,000 JPY + 380,000 JPY = 1,080,000 JPY and therefore your final taxable income is computed as B – C = 2,380,000 JPY. That puts you in the 1,950,000 JPY–3,300,000 JPY income tax bracket with a tax rate of 10% and therefore your total income tax amount Z (including the surtax of 2.1%) would be

(97,500 JPY + (2,380,000 JPY – 1,950,000 JPY) x 0.10) x 1.021 = 143,450.5 JPY,

probably rounded down to 143,400 JPY.

If you did not have any other deductable expenses, then you are done by now. There is no need to file a tax return, and any difference between the computed amount and the sum of your monthly tax payments is handled by your employer with the last salary of the year. If you did have other deductable expenses such as health-related expenses or if you donated some money to certain organizations, then it may make sense to file a tax return. I will write about that in a future blog post.